By Workways Commercial Strategy – Reading Time: 6 minutes

In the current macro, cash really is king, and yet every quarter, smart CEOs and CFOs make the same fundamental capital allocation mistake, they sign a traditional 3-6-9 lease, and then they start writing cheques, one cheque for architects, another for M&E, and another for IT cabling, partitioning, and furniture, before a single employee has sent an email or spoken to a client, the company has sunk six figures of Capital Expenditure into a depreciating asset they do not own.

This is no longer just “the cost of doing business,” but a structural drag on the balance sheet, agility, and operational velocity, because in 2026, this approach is especially damaging.

When Fit-Out Costs Become Dead Money

Think about it: when you lease a bare shell, you’re basically moonlighting as a construction company. You’re taking on project delays, budget overruns, and the headache of managing contractors—none of which is core to your business.

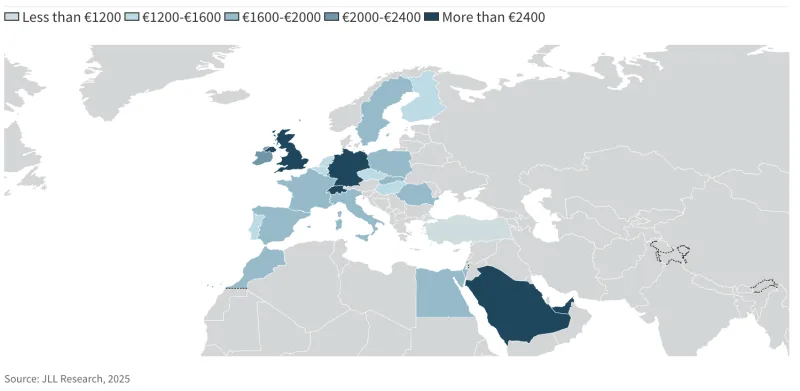

Let’s talk real numbers. JLL’s EMEA Fit-Out Cost Guide puts the average office fit-out at around €1,823 per square meter. So if you’re fitting out a fairly modest 500 m² space in Brussels or Paris, you’re looking at somewhere between €900,000 and well over €1 million upfront. That’s before you’ve even thought about proper furniture, your IT infrastructure, or decent acoustics.

This capital sits on your books, depreciating gradually, when it could’ve been working capital—funding growth, new hires, or product development.

And here’s the timeline reality: according to JLL’s project data, you’re looking at 4 to 6 months from start to finish. Four to six months where you might already be paying rent, your team’s scattered across temporary spaces, and productivity takes a nosedive.

The Exit Cost Nobody Talks About

The time dimension makes things even worse, because JLL’s Project & Development Services data shows that a typical fit-out can take 4-6 months from design to construction.

In the meantime, you may already be paying rent, your teams are working out of temporary space, and productivity is impacted while staff wait for the “real” office to be ready, so you are not just losing money, you are losing time to market, and the pain doesn’t end when you move in, under Belgian, French, and Irish commercial leases, tenants are generally obliged to restore premises to their original condition at the end of the lease.

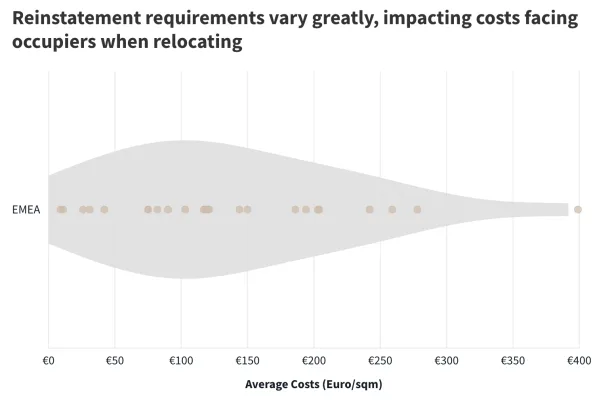

That can mean removing partitioning, repairing damage, stripping out the full fit-out, and industry estimates suggest dilapidation liabilities typically range from €50-€150 per square meter, these costs are often brushed over or underestimated at the negotiation stage, for that same 500 m space, you are probably looking at an additional €25,000-€75,000 of exit liability.

That is dead capital twice, once when you enter the lease, and once when you leave. Money you’ll never see again.

Why 2026 Is Different

The macro backdrop makes this traditional approach even harder to justify, because the European Central Bank has held interest rates at an elevated level throughout 2024 and into 2025, the highest sustained levels since 2008, and according to the European Investment Bank’s 2024 Investment Survey of almost 13,000 EU companies, the proportion of companies expecting to increase investment relative to those expecting to decrease it halved in 2024, falling to a net balance of 7%, from 14% in a single year.

The message could not be clearer, companies are capital-constrained, funding is more expensive, and boards are more cautious, in this context, CapEx-heavy leases are especially damaging, because they tie up capital in non-core assets, divert cash into non-revenue generating infrastructure, and create fixed, non-scalable liabilities at exactly the moment when businesses need maximum flexibility.

What’s Actually Happening in the Market

Corporate real estate strategies are already adapting, because CBRE’s 2024 European Office Occupier Sentiment Survey reported that 57% of companies are planning to reduce the size of their portfolios in the next three years, primarily due to hybrid work models and pressure to reduce real estate costs.

CBRE’s 2025 survey went further to show increasing appetite for flexible workspace, occupiers now plan to have 29% of their portfolios in flex space by 2027, up from 21% the year before.

Notably, 64% reported that they do not want to make capital commitments, a fit-out locks you into a footprint and a capital plan for years, right at the moment when your workforce is becoming more distributed and your headcount more volatile, you are locking yourself into an inflexible, CapEx-heavy model.

The OpEx Alternative: Infrastructure as a Service

The smartest operators we work with have shifted how they think about real estate—from CapEx to OpEx.

At Workways, we’re not selling lifestyle or vibes. We’re selling something more practical: instant infrastructure.

When you move into one of our office suites—whether that’s our new building 44 in Zaventem or our Dublin/Paris locations—we’ve already absorbed the capital risk for you.

- Fit-out? Already done. High-spec and client-ready from day one.

- IT backbone? Enterprise-grade, secure, redundant systems in place.

- Facilities management? Included in your monthly fee.

You get one predictable invoice each month. Your capital stays free. And you completely eliminate the dilapidation liability when you eventually move on.

The Hidden Cost of Time

The most under-rated cost of a traditional lease is time, 4-6 months to fit out is not just a project, it is a delay in your ability to earn revenue from your space, with the traditional model, you pay rent while the space is unoccupiable, teams sit in suboptimal, temporary environments that are detrimental to focus and culture, critical projects are put on hold as you “wait for the move,”

With Workways, the unit of time becomes very different, you sign on Tuesday, you open on Wednesday.

With labor costs in EMEA rising over 12% in the past 12 months, and fit-out costs rising another 5.2% year-on-year, according to JLL, every month of delay is expensive, speed to revenue becomes a board-level metric.

Why Investors Care: The IFRS 16 Factor

This is not only a cash flow and operational story, but an accounting and investor story.

Under IFRS 16, traditional leases are placed on the balance sheet as right-of-use assets with corresponding liabilities, this increases reported leverage, impacts EBITDA and key credit metrics, and can make conversations with lenders, private equity, and public market investors far more complicated.

In contrast, many flex and serviced office agreements are treated as service contracts rather than long-term lease liabilities, this can reduce the long-term obligations that appear on the balance sheet, supporting an asset-light, variable-cost profile that investors are increasingly coming to favour.

The future isn’t about owning the furniture. It’s about owning your ability to move fast.

Let’s Run the Numbers

For PE-backed and VC-backed companies, in particular, the message from the board is clear, keep the balance sheet flexible, and avoid unnecessary long-term liabilities, stop treating your office as your “second home,” start treating it as an operational asset.

Traditional Lease (500 m² in Brussels):

- Fit-out: €900,000

- Furniture: €150,000

- IT & AV systems: €80,000

- Dilapidations reserve: €40,000

- Project management: €50,000

Total upfront exposure: €1,220,000

Workways OpEx Model:

- Upfront CapEx: €0

- Monthly invoice: Predictable and scalable

- Exit liability: €0

The Bottom Line

The EIB Investment Survey shows European firms are concerned about financing conditions and political uncertainty. Savills is reporting strong demand for flexible space with modern design and collaborative areas.

Traditional 3-6-9 leases with heavy fit-outs were built for a different era, when workforces were stable, capital was cheap, and flexibility was a luxury

In 2026, flexibility is the asset. Before you sign your next lease, calculate the true cost, compare the CapEx drag of a traditional fit-out against the OpEx efficiency, speed, and balance sheet benefits of a Workways Office Suite. Your balance sheet, and your investors, will thank you.

[Book a Commercial Strategy Tour]

Research Sources:

- JLL EMEA Fit-Out Cost Guide 2024 & 2025

- CBRE European Office Occupier Sentiment Survey 2024 & 2025

- European Investment Bank Investment Survey 2025

- Savills European Office Outlook 2025

- JLL Project & Development Services Report 2024

Fr

Fr